Gaja Capital

Mar 13, 2023 | 14:00 GMT

Flinn Seery

Key Takeaways

- Fund IV: $50mn capacity still available before May ’23 close.

- Open to investors at par despite the fund NAV trading at a substantial premium.

- A young population set to become larger than China’s.

- India: “The office of the world, and becoming, the factory of the world.”

- India, alone, will drive 20% of global growth over the medium-term.

- A nation buoyed by the tailwinds of the “Four Ds”.

- Significant GDP growth coming: $3tn to $8tn ($2k to $5k per capita).

Why Do You Care?

At the FGIC, we’re a thematic club that tends to focus on disruptive technologies.

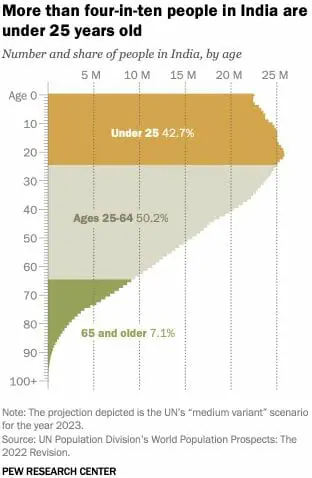

The reason we organised this call was Pew Research’s announcement that India is surpassing China as the most populous nation, and as we know, the quality and quantity of human capital are key drivers of economic growth. It turns out, 93% of the population are working age and 43% are under 25. A stark contrast to much of the Western World, China and the USA, where increasingly aging populations continue to way heavily on public spending and the ability for governments to encourage economic growth through capital injection.

As you’ll read below, Gaja Capital founder, Gopal Jain, explained that India’s fortune is being buoyed by four mega macrotrends, which he calls “The Four Ds.” Demographics, as touched on above, is just one of them.

CALL SUMMARY

Gopal Jain

Gopal is a serial financial entrepreneur, having started his first investment advisory firm whilst in college. Gaja Capital, his third venture, started in 2004 and has become one of the most established PE firms in India.

“I won the lottery of life with my parents… my mother was a stay-at-home mum who invested her savings in the stock market. So I made my first investment aged 13.”

India and The Four Ds

Deglobalisation

“By the end of the decade, India will not only be the office, but also the factory of the world.” Gopal believes India has the best digital infrastructure in the world, being the only country than can outsource at scale, with merchandise exports set to grow from $395bn in 2021 to $1.2tn in 2031.

Digitalisation

The domestic sector is set to grow from USD 300bn today to USD 3tn in 10 years and this is Gaja’s core focus. The e-commerce market will grow from USD 51bn to USD 226bn in 10 years, with digital retail transactions nearly doubling from 37% in 2021 to 69% forecast this year.

Decarbonisation

According to Gopal, the daily energy consumption of the average America person is 11x that of the average Indian person. The net-zero target is 2070, an achievable goal and rightly, a good time after Europe’s.

Demographics

As the slide in the deck shows, the median age is 28 years old, 11 years younger than China. Demographically, the population is seeing a huge rise in upper-middle and high-income households – from 26% in 2021 to a forecast 46% in 2031.

Some Key Questions

What of the currency?

‘In 2015, the government introduced the Monetary Policy Committee with an inflation target of 2%-6%. Since then, INR annual volatility is down from 8% to 2-3%. This has helped improve confidence in the currency.’

Is the digital tech theme not experiencing a rotation away from investor favour?

‘Yes, and that makes it more interesting! Buy when others are selling, as Warren Buffett taught us.’

Do you take companies to IPO? What’s the average size of PE company?

‘We specialise in taking $15-20mn revenue companies and growing them to $100mn in revenue at which point we look to IPO them.’

Is there any contagion risk here with Adani?

‘Many believe some Adani stocks are overvalued but international banks like Morgan Stanley have exposure to the bonds. Either way, this is a fraction of Indian GDP and we have no exposure so are not worried but are following the story. Certainly, in light of SVB, it’s an old story.’

How do you help businesses you invest in?

‘At the minimum, we put someone on the board. This is Level 1. But we have three levels of active value-add. At the top end, we introduce our partners and get involved in a hands-on way in the operations themselves.’

How big is Gaja Capital?

‘As an organisation, it employs 15 people, not including back and middle office staff. Our four funds have made circa 25 private investments to date, of which 12 are still actively managed. Fund IV is open to investors, at par, until May ’23.’

Summary

At the core of the Indian theme is demographics, even in an increasingly automated world, it’s people that run machinery and write software.

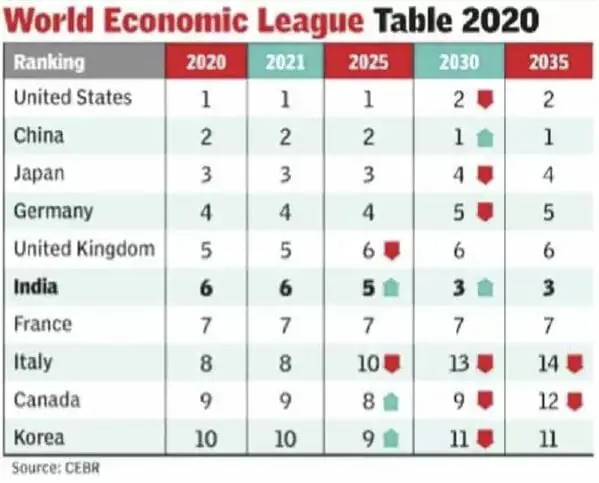

Many believe India will become the third largest national economy by 2030, with GDP set to grow USD3tn to USD8tn, or equivalently USD2k to USD5k per capita.

Relative to many nations, the inflation rate is low, posting 6.4% last month. Furthermore, Covid-19 had a lower impact on the Indian economy than many others, and the governmental spend and burden was far lower – Gopal quoted 1.4% of GDP versus the UKs 9%.

“India is working in the best interests of its people and its nation.”

Although he admits that domestic politics has gotten in the way of growth in the past, he claims India is run in the interests of the people. Something some may argue, many Western nations have lost sight of. And with that in mind, and with “The Four Ds” mega-trends behind it, we expect to see an increase in the velocity at which India’s economy grows through the decade.