Harris “Kuppy” Kupperman

Feb 1, 2023 | 15:12 GMT

Lewis Dalgliesh

Key Takeaways

Largest position => SPUT uranium

Long Florida real estate (St Joe)

Offshore drillers look cheap (Valaris and Tidewater)

$200+ oil is the market’s biggest tail risk

Everyone loves a bonus stock (read on)

Why Do You Care?

Harris “Kuppy” Kupperman, of Praetorian Capital, explained to us why a combination of thematic and inflection investing has enabled him to seek and realise multi-baggers whilst limiting his downside risk.

He defines inflection investing as the opportunity set arising when an industry or corporation is starved of capital and an event, technology or secular change enables the trajectory reversal. The result is positive returns of capital but the focus is always on balance sheet strength and cash runway.

“We need to know that revenue and earnings are accelerating. That’s what guides a good investment and ensures you don’t ‘buy cheap’ just to be holding something even cheaper down the line.”

The call was full of actionable investment advice and some interesting, off-the-radar, listed names. A recording will follow.

Uranium

Kuppy’s largest position is in the Sprott Physical Uranium Trust (SPUT). When discussing the Kazatomprom price target he noted that people tend to get fixed on the ten-year average. “Things tend to under or overshoot. Perhaps they’re hoping for $70/lb but maybe it hits that on it’s way to $500/lb.”

He believes the uranium spot price will overshoot because of the deficit created due to the reversal from underfeeding to overfeeding in the enrichment process. This is the inflection trade in uranium that he believes will widen the deficit faster than new mines coming online are able to close it, because more resources are used to reach the desired enrichment level.

Kuppy speaks with certainty that SPUT are trying to corner the market, and explains it’s why they don’t offer offtake agreements. It’s easy to issue shares and when capital is raised they’re buying physical uranium.

“The trade is on until the regulator steps in.”

When asked what the catalyst will be for a higher spot price, Kuppy is honest.

“I don’t really know. I just know it’s cheap now so I’m hoarding. It’ll go eventually and when that time comes, if you’re not in already, you’ll be buying more expensive.”

Oil

Kuppy believes the biggest tail risk for investors today is the overshooting of oil, to around $200/bl, because the price of shipment is always passed onto the consumer. Poorly hedged airlines, logistics and transportation companies will likely see suppressed margins in the short-term, until prices are shifted to the consumer. If you agree with Kuppy’s risk sentiment, an overexposure to such sectors might be best avoided.

His favourite stock picks in the sector are offshore drillers where he believes value can be found in just jurisdictions with large offshore deposits where equipment, relative to onshore drillers, goes for 10 cents on the dollar. (It’s worth noting that offshore drilling is approximately two to three more expensive than onshore drilling, due to the specialized equipment and infrastructure requirements).

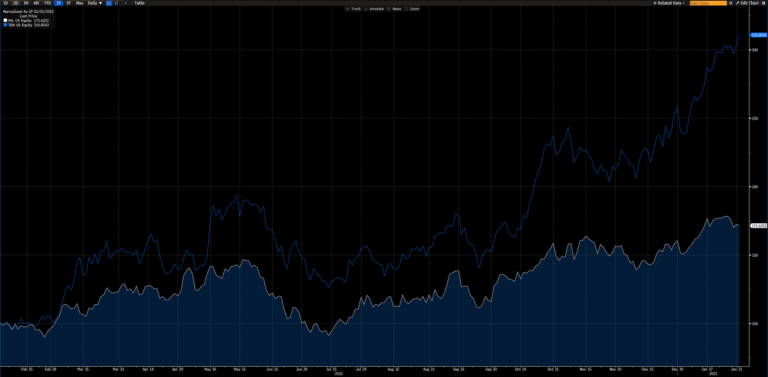

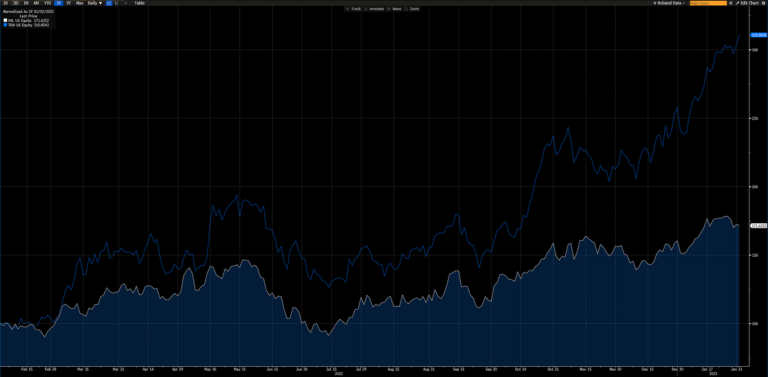

Kuppy’s favourite offshore drillers currently are Valaris and Tidewater. The former having underperformed the latter considerably over the past year, as the comparative graph below shows.

Real Estate

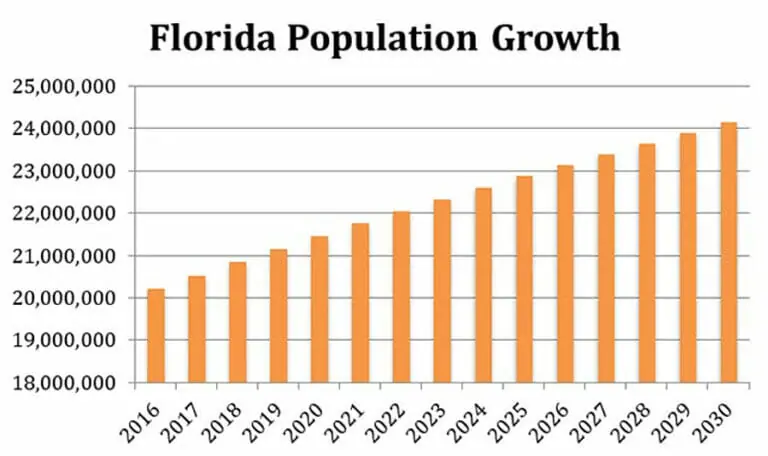

The second largest position in the fund is real estate, and in particular in Florida, which Kuppy rightly pointed out is among the highest net-migration states in the US as the Southern States continue to be a draw. Interestingly, in 2022, Illinois was named the highest outbound state for the 9th year in a row.

In his fund, Kuppy chooses to play the real estate theme in a niche way, through a stock called St Joe – a Northwest Florida based real estate developer and asset manager. (For more on the company, visit the beautifully simple URL: www.joe.com).

Kuppy believes that real estate is always a good bet when populations are rising and Florida is undergoing both a national and international immigration boom. Adding that, in terms of capital protection and leverage, St Joe is one of the safest businesses he knows. The company owns over 170,000 acres of land in Florida, which for context, is about 1 in every 250 acres of the state.

It’s not a REIT. It’s a different, direct, pure-play and liquid way to diversify your portfolio through a real estate investment (an asset class Diego Parilla also recommended when he addressed members last year) and in a geography with population growth tailwinds.

Source: Investments in Sarasota

Anti-Ponzi’s

Having now spoken to him, the title of the Forbes interview last-year seems a little off: “Meet The Investor Willing To Put His Money Into Ponzi Schemes. His Fund Is Up 593%.”

In fact, he spoke of almost the exact opposite. The opportunity that arises when a new-age tech firm puts an ‘interesting wrinkle’ on a traditional business and has a large marketing budget. Uninterested in turning a profit, they grow the revenues only and take a land-grab approach.

Correspondingly, the incumbents reduce costs to stay afloat and then often get to acquire these failing businesses and consolidate their market share down the line. The example he gave was WeWork and Regus. Another example that comes to mind in the UK is the new-age utility providers like Bulb (now in administration and getting bought by Octopus). Meanwhile, Centrica, which could be bought for 0.2x sales and 3x earnings not so long ago, now trades at a 52-week high.

Bonus Stock

Rather generously, before signing off, Kuppy offered one last ‘bonus stock’ that he’s currently averaging into, and as such is still at cost on – Journey Energy.

His thesis is the firm belief that oil and gas will go a lot higher and when they do, many assets with high operational gearing will react in kind when the cash flows kick in due to the high breakeven rates. These particular assets are net accretive to sell and are being offloaded for cheap (2x cash) by major players who don’t want the debt on their balance sheets.

As a result, Journey (with its experienced consolidating executives) is rolling them up and taking the ARO liability risk with them. Something Kuppy holds little concern over.

“I’ll sell in a few years and it’ll be someone else’s problem.”

Portfolio

Kuppy describes his investment approach as having no rules.

“We have no sector bias but go where opportunity takes us.”

Explaining that his only geographic limitation is the English-speaking world for due diligence purposes.

He usually plays between 6 and 12 long-only themes in a concentrated portfolio, but currently, due to high conviction is running just four.

Kuppy is currently taking outside capital into his Praetorian Capital fund. If anyone is interested, we’ll gladly put you in touch.