2023 Macro Outlook

Apr 3, 2023 | 14:00 GMT

Flinn Seery

Apr 3, 2023 | 14:00 GMT

Flinn Seery

Mar 3, 2023 | 5:00 GMT

Flinn Seery

Key Takeaways

Why Do You Care?

Jumia’s share price has fallen 95% from its highs, when the stock was branded “The Amazon of Africa”. Since then, the two co-founders have stepped aside, and Francis Dufay, an experienced Jumia executive who previously managed 8 countries, has taken the top job.

Our dialogue with Francis was friendly, but he seems like something of a man on a mission. The company offered some key talking points they wanted to address, keen to get across both the cost-saving message as well as the growth potential in the second and third business lines.

Although Francis has no intention of closing any of Jumia’s current geographies, or open new ones, he talks positively of the road ahead and believes growth will come organically where the company has laid its’ roots – especially given Africa’s population growth forecast – the highest of any continent out to 2050.

CURATED SUMMARY

Business Overview

The three core revenue lines are…

E-commerce Competition

Francis explained that there’s little competition in e-commerce. Only in Egypt (where Jumia competes with Amazon and was recently rated the primary e-commerce brand) and South Africa (where due to Takealot’s presence, it focuses only on fashion).

Operating in Morocco, Algeria, Tunisia, Tanzania, Egypt, Uganda, Kenya, Nigeria, Ivory Coast, Senegal and South Africa (retail and fashion only), Francis says there is ‘very little structure or organised e-commerce competition’ – but that local players come and go.

E-commerce penetration is around 1%, so the main competition is with offline markets and localised shopping. In this way, locals tend to still buy offline unless they can beat the price, product, brand or all three online.

The ‘Amazon of Africa’

Although this title is flattering, Francis said Jumia is building a very different business model and the only similarity is the e-commerce platform. Furthermore, Amazon is capex intensive, and they leave a lot to local private initiative.

On the point of AWS (Amazon Web Services) it was noted that Jumia has nothing similar. This is Amazon’s jewel in the crown.

Cost Saving Strategy

Francis understands, with the benefit of hindsight, that Jumia tried to do too much. The new simplification strategy has seen the closing of several businesses, including Jumia Prime, restaurant delivery and, in 8 markets, logistics-as-a-service.

With 20% of the global headcount and 60% of managerial roles in the Dubai HQ cut in Q4, Dufay is implementing an intense cost cutting strategy.

“We need to prove to shareholders that we can run this business at a much lower cost.”

Key barriers to adoption have included macroeconomic short-term pain, which has heavily impacted retail supply chains and high inflation (50%+ in the countries of operation!)

The focus now is to drive e-commerce to higher levels, optimising on costs and synergies across markets.

Logistics as a Service

The big challenge is to distribute outside of the capital cities where few companies have built sufficient supply chains.

“It’s a nightmare to build a distribution network”.

That’s why Jumia took the leap (and spent the money) building a logistics platform which covers, for example, over 100 towns in the Ivory Coast, to which it ensures 3-5 deliveries per week.

New customers are added to the distribution networks which add palettes to the trucks. For example, Jumia has many banking and bakery clients, distributing packages, letters, and baked goods.

The key point is that this isn’t an M&A play but market consolidation onto one technological and logistical platform, which is owned and run by Jumia. It’s warehouse management, asset-light, high-margin with SME partners running the trucks.

Finances

No timeline to profit at group level was provided but there is an aim to half the EBITDA loss in 2023.

The staff cuts are nearly done, and the QR restructure reduced G&A expenses dramatically.

At Q4’22 end, there was $230mn in cash, not a lot when compared to the $205mn annual loss. But the burn will apparently be halved this year, providing the company with up to three years of runway.

More money will need to be raised.

Going Forward

In 2023, Francis wants to be judged by his ability to run the business on a hugely different cost basis.

“Right now I’m focused on implementing the right fundamentals for growth in the medium term.”

Crime

On crime, legal recourse and logistics in EM markets, Francis spoke confidently. It’s seen as a big hurdle and problem, but Jumia has fully digested and adapted its logistics to cover the risk and complexities of the markets in which it operates.

For example, the riders remit cash on daily basis and Jumia only deals with the SME partner so doesn’t need to collect rider by rider.

Summary

This stock isn’t for the faint-hearted. A question mark hangs over the cash runway with future dilution not off the cards.

But Francis Dufay, seems to have a plan in place. A seasoned executive, he understands the business as well as anyone and recognises its past mistakes.

His focus on profitability will be well received to current shareholders, long term holders of which, could be as much as 95% down.

But the shares are finally range-trading. And perhaps, for the first time in years, the upside outweighs the down, especially with Jumia trying to dominate in a 1% penetrated sector in which it’s often the only market participant.

Feb 15, 2023 | 10:04 GMT

Lewis Dalgliesh

Key Takeaways

Why do you care?

Having returned c.160% to members since the Jan-21 recommendation of going long the EUs Emission Trading System (ETS) carbon futures, we wanted to catch up with world renowned experts and club friends, Lawson Steele and Mark Lewis to see if the trade is running out of steam.

The answer – no. Both panellists appear extremely bullish, speaking in harmony on the structural story, supply side clarity and oncoming step change in demand, only disagreeing on the pace of the deficit.

The video can be watched here on the portal here, and a call summary follows.

Mark Lewis

Mark believes that the most undercommented and underappreciated part of the carbon story is that the market is already more than half-way through its lifetime. Launched in 2005 (18 years ago) and with a ‘cap’ (total amount of emissions allowed) which falls to zero in 2039 (in 16 years’ time), and as of Dec-22 a Linear Reduction Factor (LRF) set to increase from 2.2% to 4.4% in 2028.

Due to a deal brokered in December, about 300mn allowances that were supposed to be auctioned post-2026 will be frontloaded and now auctioned between 2023-2026. However, due to the mechanism of the Market Stability Reserve (MSR) Mark’s modelling shows that 100mn of these will be wiped out and, in fact, only 200mn will come into the market. This means there will be more supply in the short-term, but, long-term it will make supply of allocations even tighter.

“The way the legislation is written is so bullish because the target is for zero emissions (not net-zero but absolute zero) by 2039.”

Mark believes, from an engineering perspective, such an achievement is a very difficult thing to do anyway. And the structural deficit is further exacerbated by the Fit For 55 initiative which will phase out free credits – including from the aviation industry in 2027.

Lawson Steele

Lawson explained that carbon credits are the only commodity in which you can be very sure of both the demand and supply side of the equation.

“The supply side is a given. It’s simple math.”

He spoke of a raft of legislative changes which make the outlook even tougher for supply and will only go to increase demand as corporates that have been receiving carbon credits for free before no longer will. “The market is getting tighter, the demand side you can play with, plus or minus 10% but it doesn’t change anything. It’s a supply side story. There are no natural sellers of this commodity.”

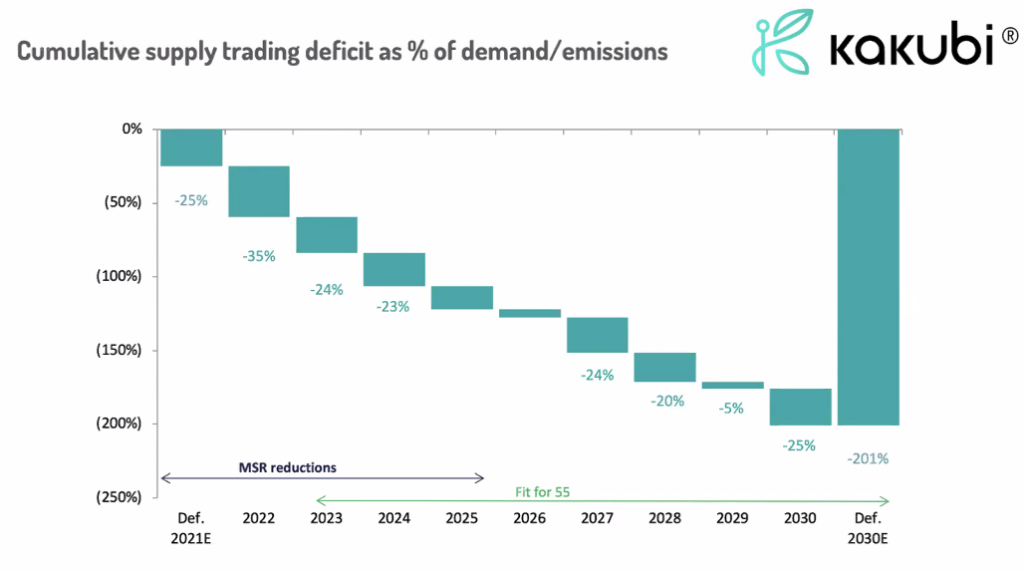

The chart below, from Lawson’s Kakubi deck, shows his 2030 deficit projections out to 2030 including the Market Stability Reserve (MSR) reductions and Fit For 55 initiative.

Voluntary Market

The voluntary market is far smaller than the European carbon market (EUR 1bn vs EUR 700bn). It was discussed how difficult it will be for corporates to deal with the compounding shortage of supply, but Mark claimed, “the EU don’t want to hear it” further noting that following the Kyoto Protocol, 1.6bn of carbon offsets were allowed into the EU ETS in 2019.

“Without these we wouldn’t have that inventory and the price would already be a lot higher.”

Kakubi

Lawson Steel’s new venture, Kakubi, enables retail and institutional investors to gain on blockchain exposure to physical carbon. An investment that aims to reduce pollution and make positive and largely uncorrelated returns.

The coin (you’ll need a crypto wallet) is pegged to the EUA price and has outperformed Bitcoin and Ethereum over the past year. Fully compliant with Swiss law and regulation, this is a non-anonymous alternative investment.

To learn more, head to the website, or reach out to investors@kakubi.com.

UK

Mark pointed out that the UK ETS market is even tighter than the EUs. Following Brexit, the inventory was effectively given away and Mark said, “I would be more bullish on the UK market than anywhere else but the liquidity is poor.”

It was discussed that a change of government could see a Norway or Swiss style set up where the UK ETS is connected to EUs ETS, where neither country is part of the EU.

Salzgitter and RWE

It seems most corporates are asleep at the wheel, unaware that the carbon tax is coming and how it is going to affect their earning power. Interestingly, a couple of names were discussed that don’t have their head in the sand, but instead fully hedged themselves from decades of carbon exposure a few years back and are now sat on valuable off balance sheets assets as the carbon price has gone up.

One such name was RWE. “When I was an equity analyst I covered RWE and I offered the CEO my time to explain what was coming.” Incredibly, the value of the carbon offset asset (c. EUR 10bn) is a multiple of the value of the company’s lignite mining operations (c. EUR 2bn).

The other name was Salzgitter.

California

At some point, to incentivise the goal of achieving carbon neutrality by 2045, legislative changes will likely take place in California as they have in the EU. This potentially presents an investment opportunity, but it’s worth noting that the target is for net neutrality not absolute zero and it’s six years after the EU’s 2039 target.

Due to differing supply and demand dynamics in each ETS, the price in one market should not be compared to another. It’s apples and oranges. The price in California is currently below $30 and some upside, albeit slower than in the EU, is likely if and when those changes come.

Summary

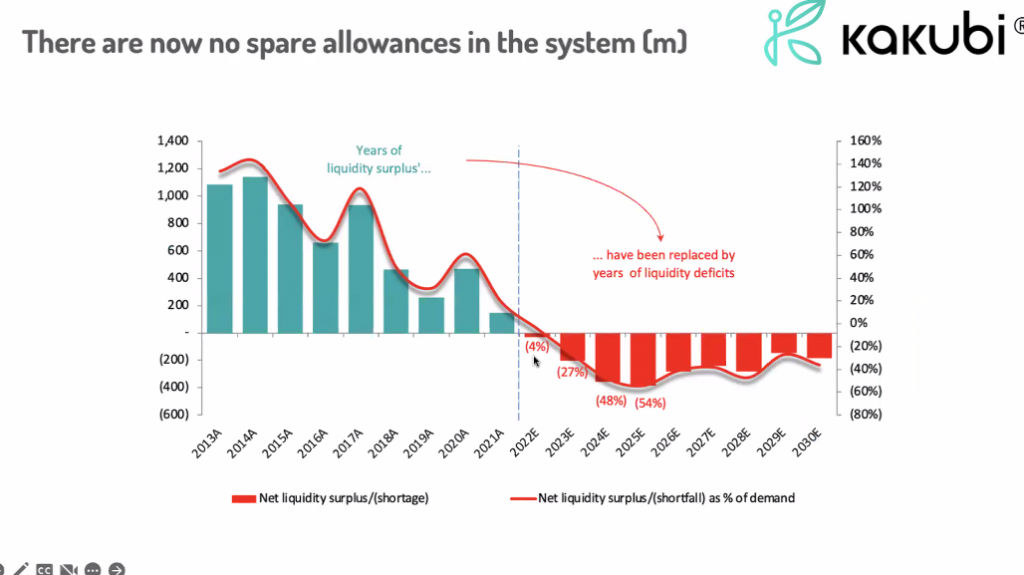

The following two slides from Lawson’s Kakubi deck really tell the story well. The first shows the lack of spare allowances as the liquidity surplus is now turning into a deficit.

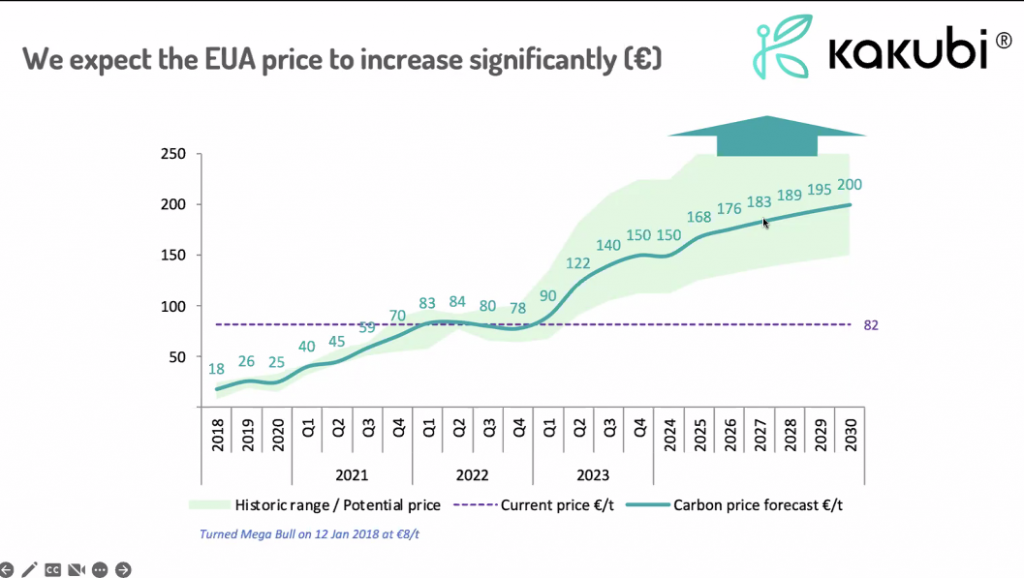

The second shows the upward trend of the forecast share price due to the structurally tight market. Both Mark and Lawson seem adamant about the supply side of the equation and subsequent structural deficit.

The only point of disparity is the demand side and ‘speed’ of price incline. This is best demonstrated pictorially below via the potential price range, the green shaded area in which the credits will likely trade.

If you’d like to go long carbon there are a number of ways of doing it including ICEs EUA carbon futures options on Interactive Brokers, by searching for “carbon emissions” on IGs spread betting platform (the underlying is the Dec-23 future), the KraneShares carbon index ETF on Saxo, and, now, Kakubi.

Jan 25, 2023 | 15:46 GMT

Lewis Dalgliesh

Graphite is a carbon-based material that is vital to the chemistry of every lithium-ion battery in the world. As a material, it’s just as important as nickel, cobalt and lithium about which many investors obsess.

Due to the explosive growth and penetration of EVs, there are far fewer operating mines than demand requires. Each mine takes up to 10 years to bring to production, meaning it’s almost certain that we will see supply chain bottlenecks and rising prices in future years.

Reflex Advanced Materials is bringing graphite production back to the US, lessening dependence on China, which has been a successful strategy for other public companies like MP Materials ($5bn market cap).

For those interested in a more detailed summary and the name of other public companies mining graphite, please read on.

Yesterday’s call was educational, timely and full of actionable ideas. Our thanks to George Miller, Paul Gorman (let us know if you’d like to be put in touch with either) and all of those who attended and participated.

George Miller – Benchmark Minerals Intelligence, Senior Analyst

Paul Gorman – Reflex Advanced Materials, CEO

The quality of questions really helped get to the core of the story as well as highlight a few interesting areas of concern.

For those unable to join, please find a summary below. A chapterised recording will be made available shortly and featured in the weekly wrap, the Reflex Advanced Materials investment deck can be read here.

At the outset, George Miller, explained the natural state graphite landscape, the three core product types and their uses.

Historically graphite was mined in many countries but China, which was able to excavate at such a low cost, made other nations uncompetitive. The last producing graphite mine in the US, Black Butte, was situated in the Ruby Graphite deposit in Montana, and was closed in 1990. It’s now being reopened by Reflex, more on that below.

Once graphite is taken out of the ground, it’s spherinised to increase the surface area and then coated in a silicone, making the material more efficient and the product more valuable in the global market. The financial viability of a mine which doesn’t do this in-house is far lower. The Chinese still dominate the spherinised market but new mines coming online as a result of the demand shift will take ownership of this process as well making the businesses much more sustainable.

The coating end of the industry is where a lot of value-add can be found and a lot of IP exists, which is why some automakers are now looking to take ownership of graphite and this process further downstream.

Global production currently sits at around one million tonnes per year, with the average mine producing 30,000 tonnes. The booming EV industry, which Benchmark Minerals Intelligence, sees growing at a 25% CAGR through to 2030 has created such demand that there is now a huge structural and forward deficit. As George explained, there is a requirement for hundreds of thousands, and eventually millions of tonnes more to be produced each year.

Graphite has an enormous number of uses. It can withstand very high temperatures and as such is used in tools to make and melt steel. It’s used in pencils and can be found in mobile phones and laptops as a cooling material to stop overheating. As a conductor of electricity it’s used in the electrodes of solar panels and in generator coils of wind turbines. It’s anti-corrosive nature sees it be used as an emulsion as well as a lubricant in paints and coatings.

Most importantly to the investment case though, is graphite is used in EVs. It is the core component of the anode in a lithium-ion battery, and the most common element. The average EV battery contains 1-2kgs of graphite and the average EV, due to the wiring, paint, and thermal insulating properties, contains 50-100kgs!

“The average EV contains 50-100kgs of graphite.” – George Miller

In short, Benchmark Minerals Intelligence, forecast a graphite demand CAGR of 16% through to 2030 – almost entirely from EV market.

Paul walked us through the pure-play public equity investable universe, noting that many of the following Western names are still not-producing. This, he says, bodes well for Reflex Advanced Materials which is coming off a low base, with a market cap of C$25mn but is in much the same position.

Bloomberg’s equity screening tool shows 39 publicly listed mining companies with the word ‘graphite’ in the company description. Most listed in China.

The EV demand has brought with it a rationale for new players to enter the industry which is why four of the five names listed above are not yet producing but already fall in the micro-cap (larger than the $50mn threshold nano-cap) bucket.

Member, Mark Astley, noted how many of these names have sold off over the past couple of years, a fact shown below – a normalised share price chart of the basket from June 2020.

It seems the stocks were overbought on early EV hype. But having sold off, and now with material EV penetration coming through, a viable long-term investment case emerges.

Sep 20, 2022 | 15:16 GMT

Lewis Dalgliesh

Jul 2, 2022 | 17:22 GMT

Lewis Dalgliesh

The structural arguments Pierre gave for being a commodity bull (in particular oil, copper and US LNG) are very compelling.

German leaders seemingly grow more confident that the months of work to stockpile and diversify energy sources may help them blunt Russia’s weaponisation of energy exports, and so, it seems, Russia is now playing its final gas cards. Last Friday, Germany was completely cut off from its Nord Stream pipeline, and yet the prices of natural gas fell sharply, down c.15% since. Not something one really picks up from the news.

The decline suggests the worst-case scenario may be behind us and priced into markets that believe Europe can make it through the coming months. However, it’s going to be tight, and dependent on a mild winter.

Whilst chatting with utilities expert Mark Lewis, Pierre also pointed out that next year may be just as tricky, because much of this year’s gas storage was initially supplied by Russia earlier in 2022, so restocking will take longer than expected.